does new hampshire have sales tax on cars

New Hampshire does collect. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus.

Advertising For The 1955 Willys Bermuda Hardtop Automobile In The Portsmouth New Hampshire Herald Newspaper February 3 1955 Willys Advertising Car Ads

My neighbours who collect very expensive cars 1M do not.

. Most states have car sales tax exemptions especially for cars made before 1973 gifted vehicles and disabled owners. There is no sales tax on anything in NH. New Hampshire EV Rebates Incentives.

In fact the state is one of five states that do not have a sales tax. New Hampshire may not have a car sales tax rate but there are still additional fees to be aware of. Property taxes that vary by town.

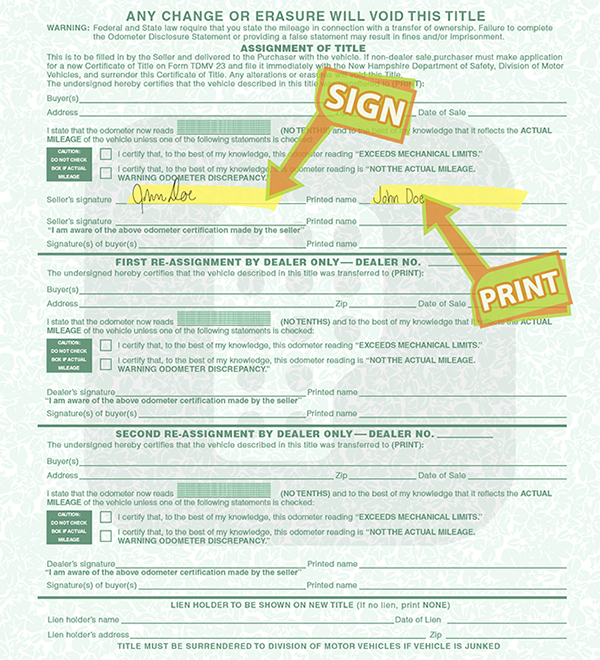

New Hampshire is one of the few states with no statewide sales tax. New Hampshires sales tax rates for commonly exempted items are as follows. For more information on motor vehicle fees please contact the NH Department of Safety Division of Motor Vehicles 23 Hazen Drive.

As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. However sales tax exemptions for vehicles arent necessary for New Hampshire since New Hampshire does not charge sales tax. If youre getting it through a Massachusetts car dealer theyll know how do the paperwork.

While states like North Carolina and Hawaii have lower sales tax rates below 5. However New Hampshire is one of five states that doesnt have any sales tax whatsoever. New Hampshire does not have sales tax on vehicle purchases.

The NH sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. Answer 1 of 6. There are however several specific taxes levied on particular services or products.

The New Hampshire sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the NH state tax. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. The State of New Hampshire does not have an income tax on an individuals reported W-2 wages.

This is tax evasion and authorities are cracking down on. What confuses people is the property tax on cars based upon their book value. What states have the highest sales tax on new cars.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. No capital gains tax. New Hampshire is one of the five states in the USA that have no state sales tax.

Montana Alaska Delaware Oregon and New Hampshire. If you live in New Hampshire when you buy a car in Massachusetts you dont have to pay Mass sales tax. The Granite States low tax burden is a result of.

In new jersey you have sales tax nexus if you have or do one of. No inheritance or estate taxes. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax.

States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. Whether you have to pay sales tax on Internet purchases is a common question in a world where consumers buy everything from clothes to food to cars online. This is tax evasion and authorities are cracking down on.

But if you come from a neighboring state such as Maine or Vermont you just cant go to New Hampshire and just. Ive personally experienced it. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax.

That means you only pay the sticker price on a car without any additional taxes. Unfortunately unless you register the car in a tax-free state you will still have to pay the sales tax when you register the. If you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car.

Are there states with. You pay it every year and it declines to around 200 but thats it. When Sales Tax is Exempt in New Hampshire.

The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to buy a car to avoid paying sales tax.

New Hampshire does not have sales tax on vehicle purchases. Only five states do not have statewide sales taxes. Nearly every state in the US implements a sales tax on goods including cars.

While states like North Carolina and Hawaii have lower sales tax rates below 5.

Registration Division Of Motor Vehicles Nh Department Of Safety

New Hampshire Title Processing Information Donate A Car 2 Charity

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Do You Need Car Insurance In New Hampshire

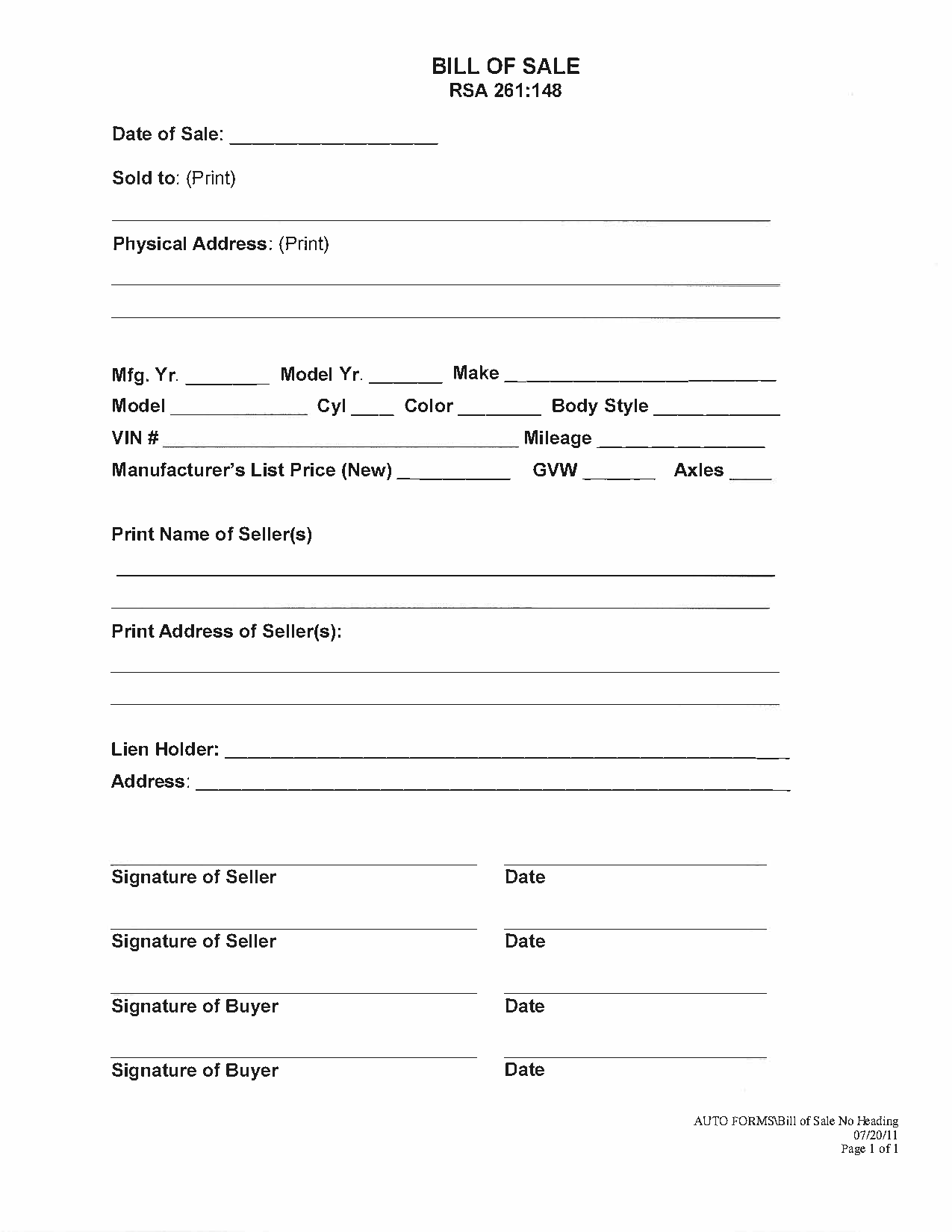

Free New Hampshire Bill Of Sale Form Pdf Word Legaltemplates

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Average Cost Of Car Insurance In New Hampshire For 2022 Bankrate

What S The Car Sales Tax In Each State Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Free New Hampshire Bill Of Sale Forms Pdf

Kia Cue Concept Kia Cue Concept Design Auto Cars Teamkia Newhampshire Kia K Car Concept Cars

We Answer New Hampshire Vehicle Donation Questions

Nissan Leaf Combined 99 City 106 Hwy 92 Nissan Leaf Nissan Leaf Electric Cars Hybrid Car

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price